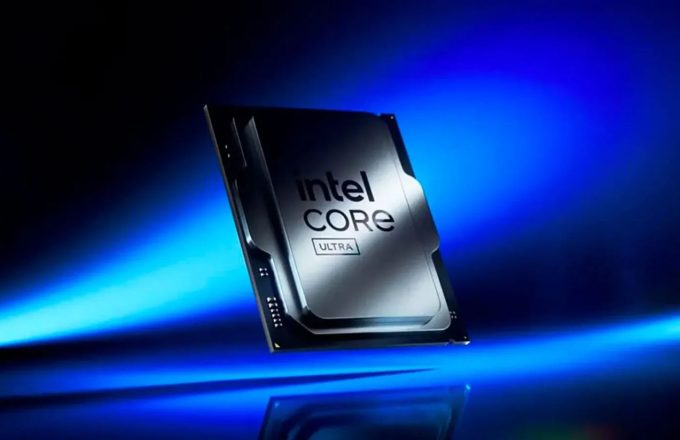

The rise of artificial intelligence has driven up the value of high-performance computing components to such an extent that some companies are now using their chips as collateral to secure financing. While consumer-grade equipment can cost thousands of euros, enterprise-level AI hardware often reaches into the millions.

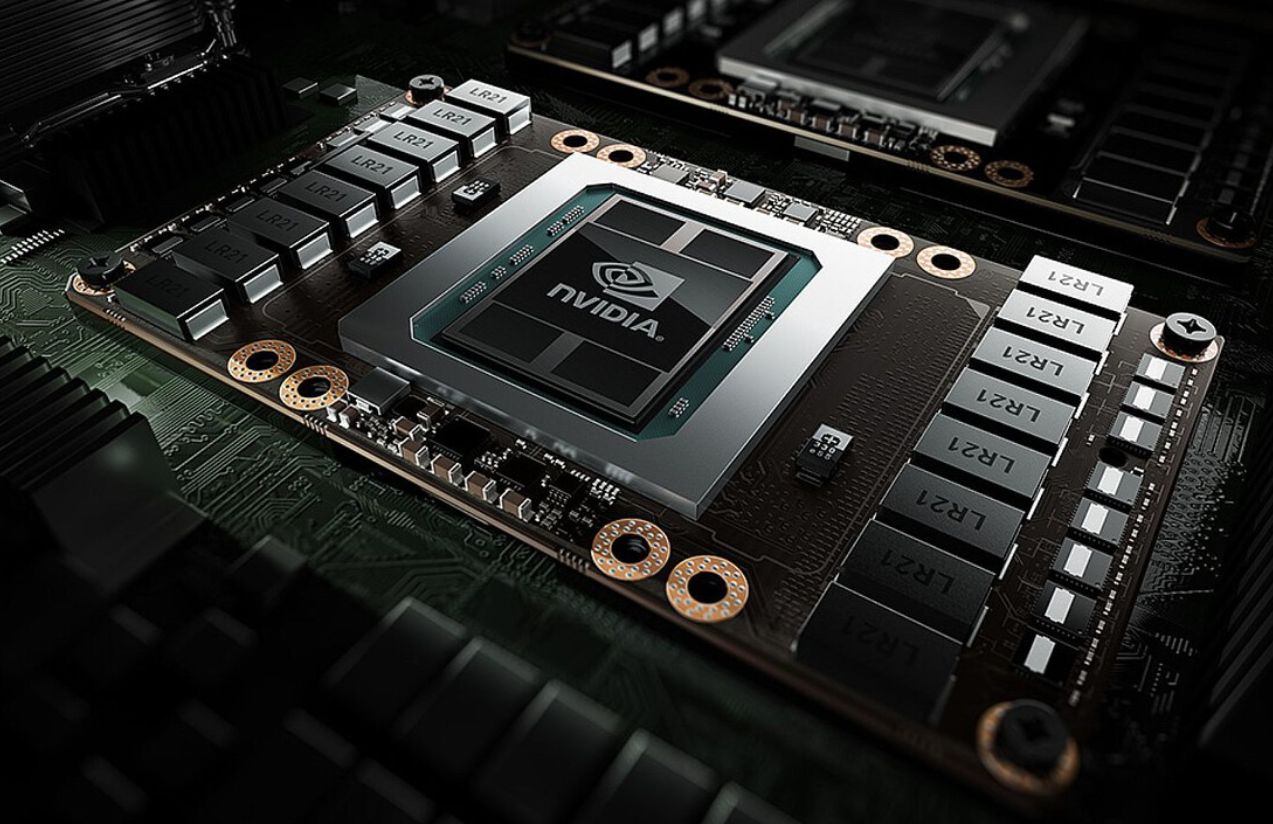

NVIDIA, a global leader in graphics processing, has become central to this trend. Thanks to its cutting-edge hardware based on architectures like Blackwell, the company offers powerful solutions such as the H100 AI GPU, capable of delivering up to 67 teraflops (TFLOPS) in FP32 operations. The H100 SXM model, for instance, is priced between $27,000 and $40,000 per unit, meaning a rack of eight can cost upwards of $320,000. For many companies, these systems are not only a technological investment but also a valuable financial asset that can be used to obtain credit.

Startups in the cloud computing sector are already embracing this strategy. According to the report “Project Osprey: How Nvidia Seeded CoreWeave’s Rise”, published by The Information on March 12, 2025, Fluidstack — a cloud services startup — secured over $10 billion in funding from financial institutions like Macquarie by using its NVIDIA AI accelerators as loan collateral.

CoreWeave, another company backed by NVIDIA, was the first to adopt this approach. It used H100 chips to access loans of up to $9.9 billion, allowing it to purchase even more accelerators to fuel its operations while continuing to use them as financial backing.

However, this financing model is not without risks. Analysts warn that the value of hardware used as collateral could drop due to wear and tear or the release of next-generation components. For now, intense demand keeps prices high — in some cases even above retail — but any decline in value could undermine their use as guarantees, raising questions about how these companies would repay their loans.

The AI revolution is not only reshaping business models but also transforming how companies access capital. At the center of this new financial dynamic are NVIDIA’s chips — turning cutting-edge technology into the currency of the future.