The trade war unleashed by the U.S. government under the leadership of Donald Trump is leaving a significant mark on global markets. Consumers are already feeling the impact of rising prices on a wide range of products—and that trend is likely to intensify in the coming weeks. The world is entering uncharted economic territory.

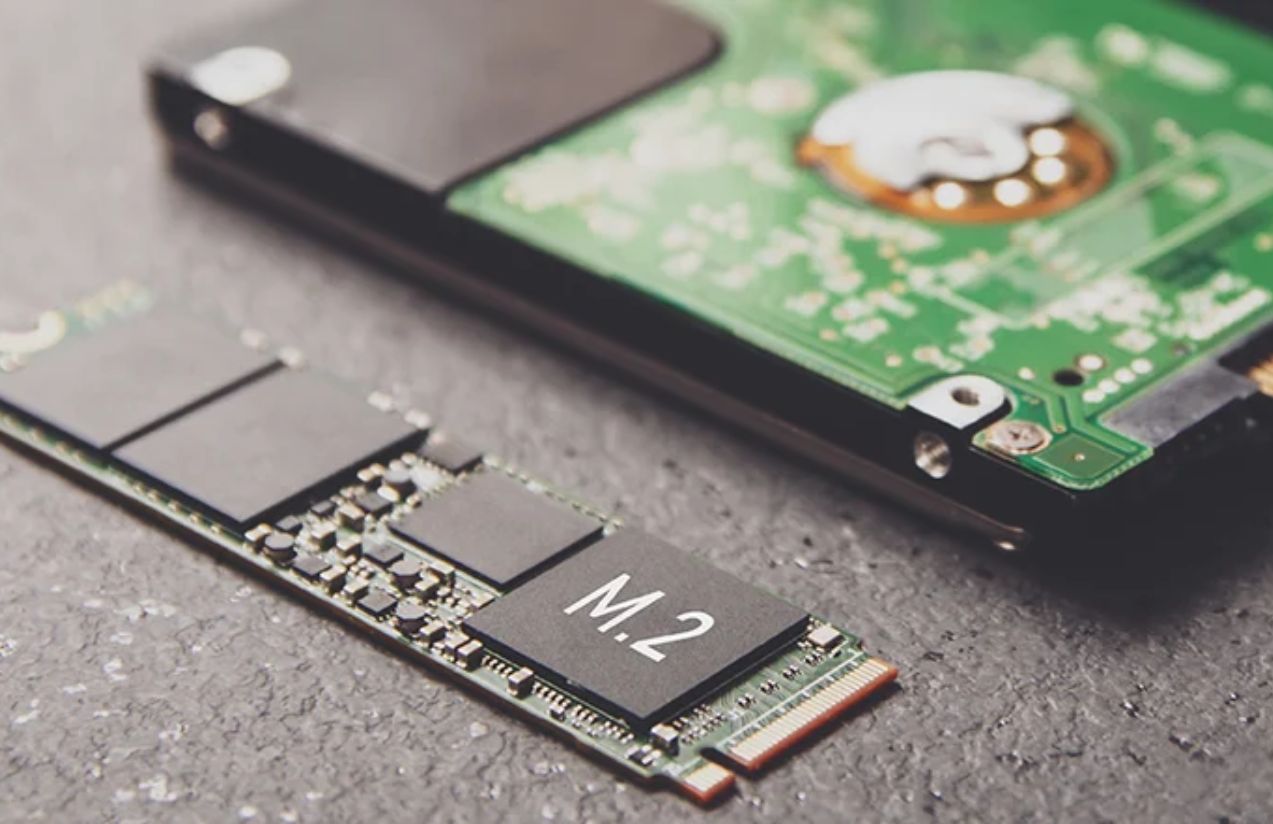

In the tech sector, much of the attention has focused on tariffs’ effects on AI chips, processors, and other critical components. However, one element has flown largely under the radar: storage solutions. That’s about to change.

U.S. tariff policies are now expected to drive up the prices of both mechanical hard drives and solid-state drives (SSDs). Leading manufacturers like Seagate, Toshiba, and Western Digital face growing challenges due to their intricate supply chains, which rely on a broad range of countries—many of which are now subject to the highest U.S. import tariffs.

Seagate, in particular, stands out as one of the hardest-hit companies, with a significant portion of its production based in China. With U.S. tariffs on Chinese goods reaching up to 145%, the company is being pushed to consider relocating its operations to the U.S. or to countries with more favorable trade relations under the current administration.

But moving a production facility isn’t easy. Mechanical hard drives are assembled in cleanrooms similar to those used for semiconductor manufacturing, where even a speck of dust can ruin a unit. This makes shifting operations a costly and complex endeavor. While SSD production doesn’t demand such strict environments, manufacturers like Samsung, Micron, and Kioxia still rely on equally complex global supply networks.

One advantage for SSD producers is that relocating assembly outside of China or Vietnam—to places like Mexico, Canada, or the U.S.—is more feasible. Still, regardless of the type of technology, storage unit prices are likely to climb significantly in the coming weeks.

Only a rollback of the current tariff policies could reverse this trend. But for now, that outcome seems unlikely.