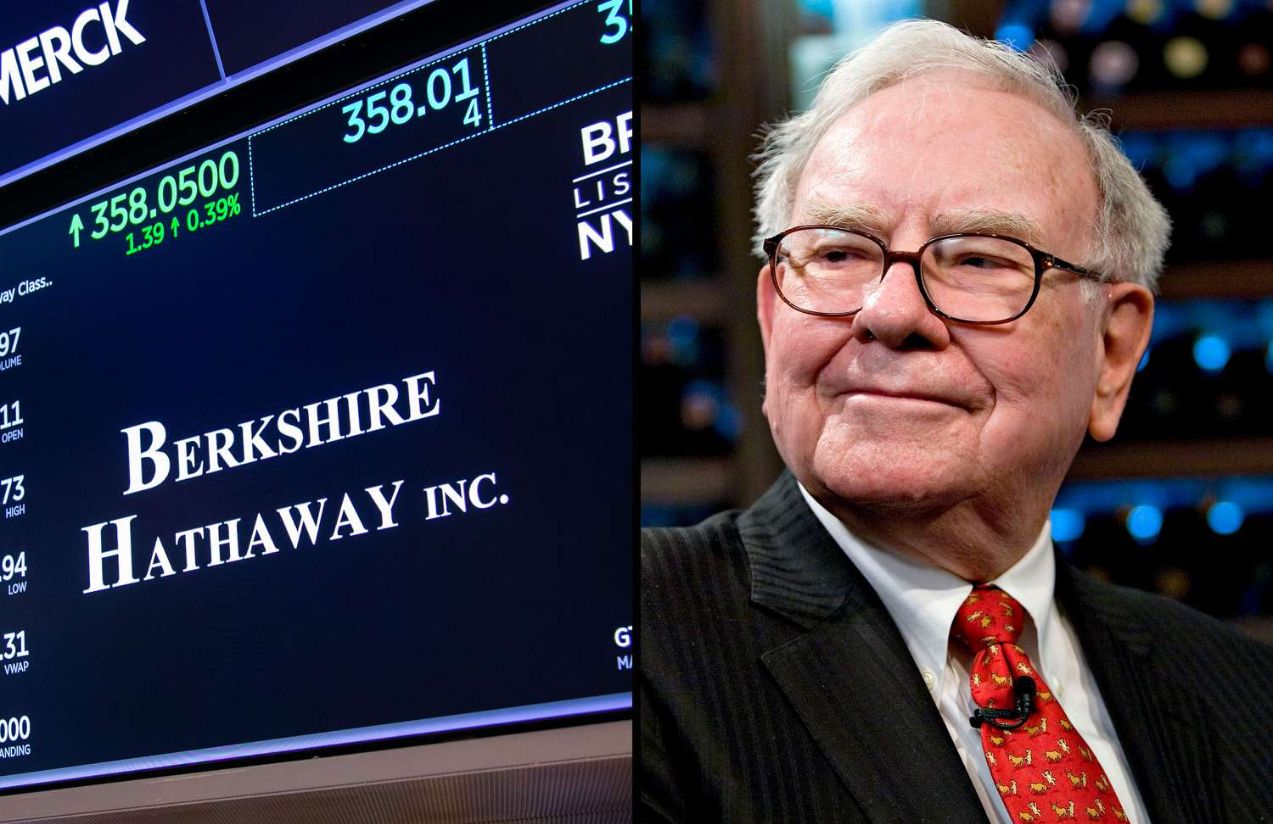

Tariffs seem to be one of President Donald Trump’s favorite tools. However, for legendary investor Warren Buffett, there isn’t much to get excited about.

“Tariffs are actually, to some extent, an act of war. We have a lot of experience with them,” Buffett said in an interview with CBS that aired on Sunday.

The Berkshire Hathaway CEO explained that, over time, tariffs act as a tax on goods and can drive up prices for consumers. “The tooth fairy doesn’t pay for them!” he joked.

By increasing taxes on imported products, tariffs disrupt trade between countries, and these additional costs are often passed on to consumers through higher prices. Many economists see tariffs as a political weapon—sometimes used in trade wars—rather than an efficient framework for international commerce.

Buffett shared his views in a rare interview with CBS News’ Norah O’Donnell. Although the segment focused on the late Katharine Graham, former Washington Post editor and a close friend of Buffett, the investor answered a few questions about the economy.

The “Oracle of Omaha” emphasized the importance of asking, “And then what?” when considering the impact of tariffs and who ultimately bears the cost. “You always have to ask yourself that question in economics: ‘And then what?’” he stressed.

Meanwhile, Trump is moving forward with new tariffs on the U.S.’s main trading partners, imposing a 25% tariff on goods from Canada and Mexico, while also increasing tariffs on Chinese products.

The Trump administration has repeatedly shifted its stance on tariff policies. Economists warn that these measures could raise costs for American consumers on essential goods that rely on global supply chains, from electronics to automobiles. Additionally, the proposals come at a time when U.S. consumer confidence is declining, and inflation concerns persist.

In response, China has announced its own tariffs on U.S. products, reigniting fears of a trade war similar to the one during Trump’s first term. This time, the European Union and other trading partners are also in the crosshairs, with the former president outlining a plan for “reciprocal tariffs” on countries that impose duties on American goods.

While Buffett did not elaborate on his remark that tariffs are an “act of war,” they have historically been linked to protectionist policies and a more isolationist foreign policy approach. In the 1930s, after the U.S. passed the Smoot-Hawley Tariff Act—exacerbating the Great Depression—French media reportedly referred to the move as a “declaration of economic war.”

Buffett has previously criticized the negative effects of tariffs. In 2016, he called Trump’s trade policy proposals during the campaign “a very bad idea.”

When O’Donnell asked him about the state of the economy, Buffett described it as “the most interesting topic in the world,” though he declined to comment further.

Buffett’s words are closely followed by investors, especially in the past year, as Berkshire Hathaway has built up a record cash reserve. In the fourth quarter, its cash and cash equivalents reached $334.2 billion, a significant increase from $167.6 billion the previous year.

Berkshire has been increasing its cash position while selling off shares in major companies like Apple (AAPL) and Bank of America (BAC), sparking speculation about Buffett’s outlook on the U.S. market.

Despite this, the company’s operating earnings hit a record high last quarter, and both its Class A (BRK.A) and Class B (BRK.B) shares closed at an all-time high just last week. Buffett reiterated that the majority of the money he manages will always remain invested in the United States.